Multiple Choice

Use the following information for questions.

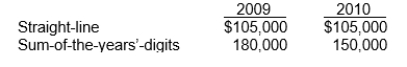

Ventura Corporation purchased machinery on January 1, 2009 for $630,000.The company used the sum-of-the-years'-digits method and no salvage value to depreciate the asset for the first two years of its estimated six-year life.In 2010, Ventura changed to the straight-line depreciation method for this asset.The following facts pertain:

-Ventura is subject to a 40% tax rate.The cumulative effect of this accounting change on beginning retained earnings is

A) $135,000.

B) $120,000.

C) $72,000.

D) $0.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Counterbalancing errors are those that will be

Q4: The estimated life of a building that

Q8: When a company changes an accounting policy,

Q18: If a particular transaction is not specifically

Q19: Detmer Constuction Company decided at the beginning

Q23: Companies report changes in accounting estimates retrospectively.

Q42: The new IFRS on financial instruments will

Q43: A company changes from straight-line to an

Q56: Companies must make correcting entries for noncounterbalancing

Q60: Companies record corrections of errors from prior