Multiple Choice

Use the following information for questions.

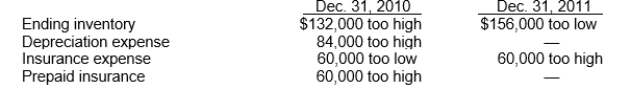

Bishop Co.began operations on January 1, 2010.Financial statements for 2010 and 2011 con- tained the following errors:

In addition, on December 31, 2011 fully depreciated equipment was sold for $28,800, but the sale was not recorded until 2012.No corrections have been made for any of the errors.Ignore income tax considerations.

-The total effect of the errors on the balance of Bishop's retained earnings at December 31, 2011 is understated by

A) $328,800.

B) $268,800.

C) $184,800.

D) $136,800.

Correct Answer:

Verified

Correct Answer:

Verified

Q9: One of the disclosure requirements for a

Q12: Accounting changes are often made and the

Q20: Which of the following is accounted for

Q22: An indirect effect of an accounting change

Q43: Use the following information for questions.<br>Link Co.purchased

Q46: All of the following statements are true

Q49: Use the following information for questions.<br>Swift Company

Q51: Use the following information for questions.<br>In January

Q53: Use the following information for questions.<br>In January

Q66: For counterbalancing errors, restatement of comparative financial