Multiple Choice

Use the following information for questions.

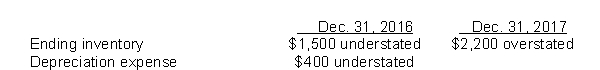

Cheyenne Ltd.'s December 31 year-end financial statements contained the following errors:  An insurance premium of $3,600 was prepaid in 2016 covering the calendar years 2016, 2017, and 2018.This had been debited to insurance expense.In addition, on December 31, 2017, fully depreciated machinery was sold for $1,900 cash, but the sale was not recorded until 2018.There were no other errors during 2017 or 2018 and no corrections have been made for any of the errors.Ignore income tax considerations.

An insurance premium of $3,600 was prepaid in 2016 covering the calendar years 2016, 2017, and 2018.This had been debited to insurance expense.In addition, on December 31, 2017, fully depreciated machinery was sold for $1,900 cash, but the sale was not recorded until 2018.There were no other errors during 2017 or 2018 and no corrections have been made for any of the errors.Ignore income tax considerations.

-What is the total net effect of the errors on Cheyenne's 2017 net income?

A) Net income understated by $2,900

B) Net income overstated by $1,500

C) Net income overstated by $2,600

D) Net income overstated by $3,000

Correct Answer:

Verified

Correct Answer:

Verified

Q1: On January 1, 2017, Robin Ltd.changed its

Q3: Use the following information for questions.<br>Fairfax Inc.began

Q6: On January 1, 2015, Missoula Corporation bought

Q7: On January 1, 2015, Reno Inc.purchased a

Q10: On January 1, 2017, Chickadee Corp.changed its

Q14: Use the following information for questions.<br>Cheyenne Ltd.'s

Q31: For accounting changes, which of the following

Q38: An example of a correction of an

Q46: Under IFRS, which of the following disclosures

Q58: Which of the following is (are) the