Multiple Choice

Use the following information for questions.

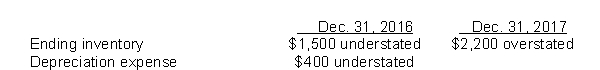

Cheyenne Ltd.'s December 31 year-end financial statements contained the following errors:  An insurance premium of $3,600 was prepaid in 2016 covering the calendar years 2016, 2017, and 2018.This had been debited to insurance expense.In addition, on December 31, 2017, fully depreciated machinery was sold for $1,900 cash, but the sale was not recorded until 2018.There were no other errors during 2017 or 2018 and no corrections have been made for any of the errors.Ignore income tax considerations.

An insurance premium of $3,600 was prepaid in 2016 covering the calendar years 2016, 2017, and 2018.This had been debited to insurance expense.In addition, on December 31, 2017, fully depreciated machinery was sold for $1,900 cash, but the sale was not recorded until 2018.There were no other errors during 2017 or 2018 and no corrections have been made for any of the errors.Ignore income tax considerations.

-What is the total net effect of the errors on the amount of Cheyenne's working capital at December 31, 2017?

A) Working capital overstated by $1,000

B) Working capital overstated by $300

C) Working capital understated by $900

D) Working capital understated by $2,400

Correct Answer:

Verified

Correct Answer:

Verified

Q10: When an entity is first transitioning to

Q24: When a company decides to switch from

Q27: Which of the following is NOT considered

Q32: On January 1, 2013, Plover Ltd.purchased a

Q34: On January 1, 2014, Detroit Ltd.bought machinery

Q35: A company using a perpetual inventory system

Q39: Eagle Corp.is a calendar-year corporation whose financial

Q40: Which of the following should be given

Q41: MissTake Corp.is a small private corporation that

Q55: Stockton Ltd. changed its inventory system from