Multiple Choice

Use the following information for questions.

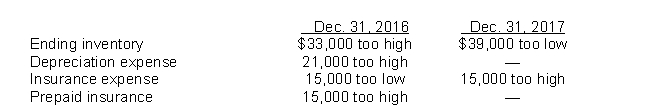

Fairfax Inc.began operations on January 1, 2016.Financial statements for 2016 and 2017 contained the following errors:  In addition, on December 31, 2017 fully depreciated equipment was sold for $7,200, but the sale was NOT recorded until 2018.No corrections have been made for any of the errors.Ignore income tax considerations.

In addition, on December 31, 2017 fully depreciated equipment was sold for $7,200, but the sale was NOT recorded until 2018.No corrections have been made for any of the errors.Ignore income tax considerations.

-The total effect of the errors on Fairfax's 2017 net income is

A) understated by $94,200.

B) understated by $61,200.

C) overstated by $28,800.

D) overstated by $49,800.

Correct Answer:

Verified

Correct Answer:

Verified

Q7: A publicly accountable enterprise changes from straight-line

Q24: When a company decides to switch from

Q27: Use the following information for questions.<br>Minor Corp.purchased

Q27: Which of the following is NOT considered

Q29: Use the following information for questions.<br>On January

Q32: On January 1, 2013, Plover Ltd.purchased a

Q34: On January 1, 2014, Detroit Ltd.bought machinery

Q35: A company using a perpetual inventory system

Q41: Which of the following is NOT considered

Q49: One condition required by IFRS is that