Short Answer

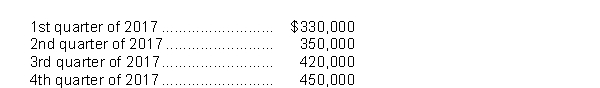

Cash dividends declared on the no par value common shares of Athens Corp.were as follows:  The 4th quarter cash dividend was declared on December 20, 2017, to shareholders of record on December 31, 2017, to be paid on January 9, 2018.In addition, Athens declared a 10% common stock dividend on December 1, 2017, when there were 400,000 shares issued and outstanding, and the market value of the common shares was $16 per share.The shares were issued on December 21, 2017.

The 4th quarter cash dividend was declared on December 20, 2017, to shareholders of record on December 31, 2017, to be paid on January 9, 2018.In addition, Athens declared a 10% common stock dividend on December 1, 2017, when there were 400,000 shares issued and outstanding, and the market value of the common shares was $16 per share.The shares were issued on December 21, 2017.

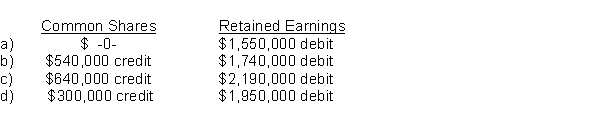

What was the effect on Athens' shareholders' equity accounts during 2017 as a result of the above transactions?

Correct Answer:

Verified

Correct Answer:

Verified

Q49: The reacquisition of issued and outstanding shares

Q50: Use the following information for questions.<br>Galba Corp.'s

Q51: On December 1, 2017, Dublin Ltd.exchanged 10,000

Q51: Use the following information for questions 74-76.<br>Instanbul

Q52: Gupta Corp.purchased its own shares on January

Q53: Use the following information for questions.<br>The following

Q55: Use the following information to answer questions

Q56: What effect does the issuance of a

Q155: Use the following information for questions.<br>When Oslo

Q158: The cumulative feature of preferred shares<br>A) limits