Multiple Choice

Use the following information for questions.

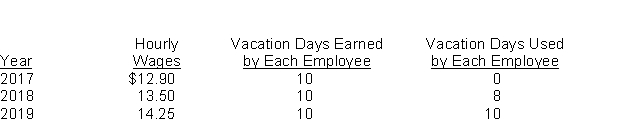

Silver Ltd.has 35 employees who work 8-hour days and are paid hourly.On January 1, 2017, the company began a program of granting its employees 10 days paid vacation each year.Vacation days earned in 2017 may be taken starting on January 1, 2018.Information relative to these employees is as follows:  Silver has chosen to accrue the liability for compensated absences (vacation pay) at the current rates of pay in effect when the vacation pay is earned.

Silver has chosen to accrue the liability for compensated absences (vacation pay) at the current rates of pay in effect when the vacation pay is earned.

-What is the amount of the Vacation Wages Payable that should be reported at December 31, 2019?

A) $39,900

B) $45,360

C) $47,460

D) $47,880

Correct Answer:

Verified

Correct Answer:

Verified

Q23: Corporation income taxes payable<br>A) must always be

Q39: Accumulating rights to benefits (for employees)<br>A) are

Q40: On September 1, 2017, Coffee Ltd.issued a

Q41: On Dec 12, 2017, Ivory Coast, CGA,

Q42: In 2017, Hydrogen Corp.began selling a new

Q42: Which of the following should NOT be

Q43: Browning Company's salaried employees are paid biweekly.Information

Q47: On February 10, 2017, after issuance of

Q49: On January 1, 2017, Wick Ltd.leased a

Q75: Accounting for GST includes<br>A) crediting GST Payable