Multiple Choice

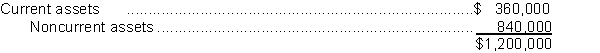

During 2017, Spokane Ltd.purchased the net assets of Tacoma Corp.for $635,000.On the date of the transaction, Tacoma reported $200,000 in liabilities.As well, the fair value of Tacoma's assets were:  How should the difference between the fair value of the net assets acquired and the cost be accounted for by Spokane?

How should the difference between the fair value of the net assets acquired and the cost be accounted for by Spokane?

A) The difference should be credited to retained earnings.

B) The difference should be recognized as a gain in net income.

C) The noncurrent assets should be reduced appropriately.

D) The difference should be prorated between the current and the noncurrent assets.

Correct Answer:

Verified

Correct Answer:

Verified

Q40: The owners of Dallas Electronics Store are

Q43: On May 5, 2017, Miami Corp.exchanged 5,000

Q44: Which of the following research and development

Q45: The cost of a patent should be

Q46: On September 2017, Princes Corporation acquired Royal

Q52: Assuming the fair value of Frosty's net

Q60: Which of the following is an example

Q67: A change in the amortization rate for

Q73: The reason that the revaluation model is

Q98: Use the following information for questions.<br>Jeremiah