Multiple Choice

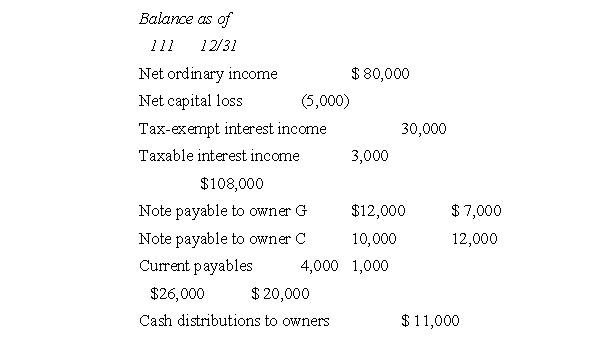

Ms.G obtained a 40 percent interest in business H on January 1 of the current year for $90,000.At the end of the year, H had the following information:  If H is a partnership or an S corporation, what is G's A.G.I., assuming she has no other income or deductions for the year?

If H is a partnership or an S corporation, what is G's A.G.I., assuming she has no other income or deductions for the year?

A) $4,400

B) $31,200

C) $32,000

D) $47,600

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Ms.G obtained a 40 percent interest in

Q3: R is an employee/owner of a C

Q4: Generally, a newly formed business expecting losses

Q5: T, a C corporation, receives a dividend

Q6: The business is an S corporation

Q8: Individuals and C corporations may reduce income

Q9: A corporation's records show the following:

Q10: Charitable contributions made by a proprietorship, partnership,

Q11: A corporation's records show the following:

Q12: A disadvantage of the partnership form is