Multiple Choice

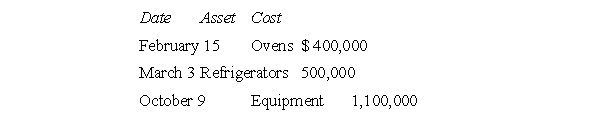

During the year a calendar year taxpayer, Heavenly Hamhocks, a chain of specialty food shops, purchased equipment as follows:  Assuming the property is all seven-year property, depreciation for the assets this year would be

Assuming the property is all seven-year property, depreciation for the assets this year would be

A) $71,400

B) $264,270

C) $285,800

D) $500,000

E) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Expenditures for research and experimentation that are

Q2: In November of this year, Creative Corn

Q3: The use of MACRS is precluded for

Q5: All methods of depreciation permitted by the

Q6: Which statement concerning class life and recovery

Q7: During the year, Fine Furnishings, a manufacturer

Q8: Last year, Taxpayer N purchased a car

Q9: During the year, T purchased the items

Q10: Riverview Incorporated, a calendar year taxpayer, purchased

Q11: Which of the following is not considered