Multiple Choice

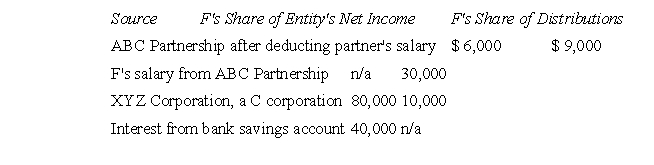

F's share of income from various sources is as follows for the current year:  F's A.G.I, (ignoring the deduction for one-half of any self-employment tax) is how much?

F's A.G.I, (ignoring the deduction for one-half of any self-employment tax) is how much?

A) $89,000

B) $156,000

C) $86,000

D) $56,000

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q19: The following represent elements of the tax

Q20: T sold the family car at a

Q21: Short-term capital gains in excess of capital

Q22: After his great performance for the U.S.soccer

Q23: A trust established for the benefit of

Q25: The partnership entity does not pay a

Q26: Which of the following is true of

Q27: Which one of the following is not

Q28: Which one of the following taxes does

Q29: Assuming the selling price remains constant, the