Multiple Choice

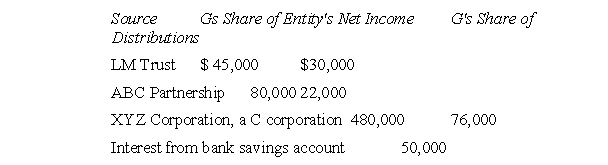

G is an 11-year-old heiress whose share of income from various sources is as follows for the current year:  G's A.G.I, (ignoring the deduction for one-half of any self-employment tax, if any) is how much?

G's A.G.I, (ignoring the deduction for one-half of any self-employment tax, if any) is how much?

A) $178,000

B) $605,000

C) $251,000

D) $236,000

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q57: Capital losses of individuals in excess of

Q58: Which of the following is a capital

Q59: The standard deduction is an amount that

Q60: Why are deductions of individual taxpayers broken

Q61: Which of the following is not true

Q63: A partnership is taxed at the same

Q64: W, a U.S.citizen, earned $6,000 from foreign

Q65: The following represent elements of the tax

Q66: Barnum and Bailey incorporated their circus this

Q67: Which of the following income is generally