Multiple Choice

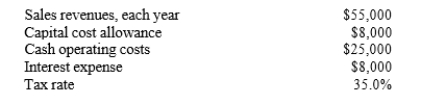

You work for the Sing Oil Company, which is considering a new project whose data are shown below. What is the project's net operating cash flow for Year 1?

A) $21,185

B) $22,300

C) $24,586

D) $25,815

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q14: Since the focus of capital budgeting is

Q19: If a firm's projects differ in risk,then

Q22: When the cash flows for a project

Q36: Langston Labs has an overall (composite) WACC

Q37: A company is considering a new project.

Q39: As a member of Midwest Corporation's financial

Q42: An increase in the risk-adjusted discount rate

Q43: Zeta Software is considering a new project

Q45: Using the same discount rate to evaluate

Q65: Superior analytical techniques,such as NPV,used in combination