Multiple Choice

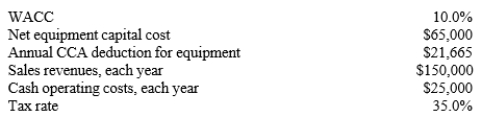

Easy Payment Loan Company is thinking of opening a new office, and the key data are shown below. Easy Payment owns the building, free and clear, and it would sell it for $100,000 after taxes if the company decides not to open the new office. The equipment that would be used would be depreciated by the straight-line method over the project's 3-year life, and would have a zero salvage value. An extra $5,000 of new working capital would be required to get this project running. Revenues and cash operating costs would be constant over the project's 3-year life. What is the project's NPV? (Hint: Cash flows are constant in Years 1-3 and the increased working capital will be recovered when this project ends. A simplified CCA is for mathematical convenience.)

A) $47,940

B) $50,464

C) $54,672

D) $55,915

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Although it is extremely difficult to make

Q15: Any cash flow that can be classified

Q21: Bing Services is now in the final

Q40: Which of the following does NOT have

Q48: Currently,Powell Products has a beta of 1.0,and

Q49: Which of the following statements is correct?<br>A)

Q51: Which of the following rules is correct

Q53: TexMex Products is considering a new salsa

Q59: Merritt Company is considering a new project

Q74: Sometimes analysts think that an externality is