Multiple Choice

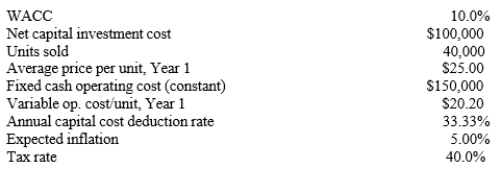

Dumpe Industries is analyzing an average-risk project, and the following data have been developed. Unit sales will be constant, but the sales price will increase with inflation. Fixed costs will also be constant, but variable costs will rise with inflation. The project should last for 3 years, and there will be no salvage value. This is just one project for the firm, so any losses can be used to offset gains on other firm projects. What is the project's expected NPV? (Note: the constant annual capital cost deduction rate facilitates the calculations.)

A) $8,536

B) $8,985

C) $9,458

D) $9,931

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Rowell Company spent $3 million two years

Q5: Sensitivity analysis measures the stand-alone risk of

Q8: Fool Proof Software is considering a new

Q11: Which of the following statements best describes

Q13: Which of the following statements best describes

Q16: You work for Athens Inc., and you

Q43: It is extremely difficult to estimate the

Q58: Opportunity costs include those cash inflows that

Q67: Estimating project cash flows is generally the

Q75: The primary advantage of declining-balance depreciation over