Multiple Choice

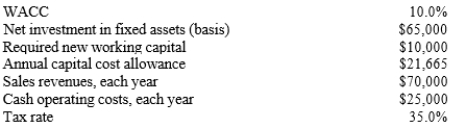

Party Place is considering a new investment whose data are shown below. The equipment that would be used would have a constant annual capital cost allowance over the project's 3-year life and a zero salvage value. This project would require some additional working capital that would be recovered at the end of the project's life. Revenues and cash operating costs are expected to be constant over the project's 3-year life. What is the project's NPV? (Hint: Cash flows are constant in Years 1 to 3. CCA is modified to smooth out the calculations.)

A) $24,112

B) $25,318

C) $26,584

D) $27,913

Correct Answer:

Verified

Correct Answer:

Verified

Q10: Changes in net operating working capital do

Q31: If an investment project would make use

Q34: Moore & Moore (MM) is considering the

Q41: The change in net operating working capital

Q53: In cash flow estimation,the existence of externalities

Q59: Merritt Company is considering a new project

Q61: Which of the following statements best describes

Q64: What is the best approach to take

Q66: Taussig Technologies is considering two potential projects,

Q67: Which of the following statements is correct?<br>A)