Multiple Choice

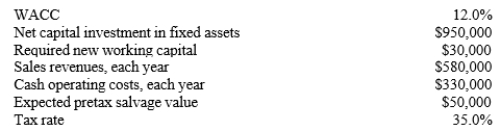

Majestic Theaters is considering investing in some new projection equipment whose data are shown below. The required equipment has a 7-year project life falling into a CCA class of 30%, but it would have a positive pre-tax salvage value at the end of Year 7. Also, some new working capital would be required, but it would be recovered at the end of the project's life. Revenues and cash operating costs are expected to be constant over the project's 7-year life. What is the project's NPV?

A) $13,965

B) $15,226

C) $16,910

D) $17,882

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Rowell Company spent $3 million two years

Q13: Which of the following statements best describes

Q16: You work for Athens Inc., and you

Q20: Which of the following should be considered

Q21: A firm is considering a new project

Q23: Which of the following statements best describes

Q28: Suppose Walker Publishing Company is considering bringing

Q60: The undepreciated capital cost (UCC) is defined

Q67: Estimating project cash flows is generally the

Q75: The primary advantage of declining-balance depreciation over