Multiple Choice

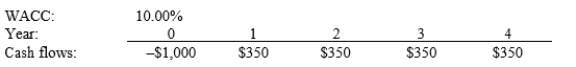

Johnson Enterprises is considering a project that has the following cash flow and WACC data. What is the project's NPV? Note that if a project's projected NPV is negative, it should be rejected.

A) $98.78

B) $103.98

C) $109.45

D) $114.93

Correct Answer:

Verified

Correct Answer:

Verified

Q15: Conflicts between two mutually exclusive projects, where

Q26: One advantage of the payback method for

Q64: Which of the following statements is correct?<br>A)

Q65: A decrease in the firm's discount rate

Q66: Hindelang Inc. is considering a project that

Q68: Edelman Electric Systems is considering a project

Q71: Scanlon Inc. is considering Projects S and

Q74: Thompson Stores is considering a project that

Q102: If you were evaluating two mutually exclusive

Q125: If the IRR of normal Project X