Multiple Choice

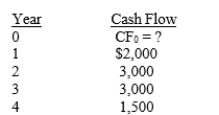

Sorenson Stores is considering a project that has the following cash flows:  The project has a payback of 2.5 years, and the firm's cost of capital is 12%. What is the project's NPV?

The project has a payback of 2.5 years, and the firm's cost of capital is 12%. What is the project's NPV?

A) $577.68

B) $765.91

C) $1,049.80

D) $2,761.32

Correct Answer:

Verified

Correct Answer:

Verified

Q20: Garvin Enterprises is considering a project that

Q22: Which of the following statements best describes

Q23: Which of the following statements best describes

Q26: Which of the following statements best describes

Q27: Which of the following statements best describes

Q28: The NPV method's assumption that cash inflows

Q29: Rappaport Enterprises is considering a project that

Q50: Projects S and L both have normal

Q88: Pinkerton Truck Rental is considering two mutually

Q96: Which of the following statements is correct?