True/False

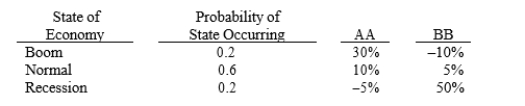

The distributions of rates of return for Companies AA and BB are given below:  We can conclude from the above information that any rational risk-averse investor will add Security

We can conclude from the above information that any rational risk-averse investor will add Security

AA to a well-diversified portfolio over Security BB.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q24: Currently,the risk-free rate is 6% and the

Q79: J.Harper Inc.'s stock has a 50% chance

Q91: Variance is a measure of the variability

Q91: A stock's beta measures its diversifiable (or

Q95: Stock A has a beta of 1.2

Q112: Ripken Iron Works believes the following probability

Q115: Assume that the risk-free rate remains constant,

Q120: A stock's beta is more relevant as

Q121: Which of the following statements is correct?<br>A)If

Q133: A mutual fund manager has a $20