Multiple Choice

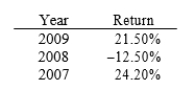

Returns for the Shields Company over the last three years are shown below. What's the standard deviation of Shields' returns? (Hint: This is a sample, not a complete population, so the sample standard deviation formula should be used.)

A) 19.94%

B) 20.45%

C) 20.97%

D) 21.49%

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q3: Which of the following statements is correct?<br>A)If

Q45: Which of the following statements is correct?<br>A)A

Q91: Which of the following statements is correct?<br>A)

Q92: Over the past 75 years, we have

Q93: Stock HB has a beta of 1.5

Q94: Stock X has a beta of 0.5

Q99: Suppose you have an asset with a

Q101: If you plotted the returns of a

Q110: If an incorrect proxy market portfolio is

Q115: According to the Capital Asset Pricing Model,