Multiple Choice

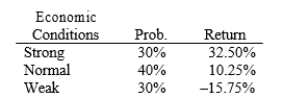

Your firm's analyst believes that economic conditions during the next year will be either strong, normal, or weak, and she thinks that Crary Inc.'s returns will have the probability distribution shown below. What's the standard deviation of Crary's returns as estimated by your analyst? (Hint: Use the formula for the standard deviation of a population, not a sample.)

A) 17.77%

B) 18.71%

C) 19.65%

D) 20.63%

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Which of the following statements is correct?<br>A)

Q4: Which of the following statements is correct?<br>A)

Q5: Which of the following statements is correct?<br>A)

Q18: The risk-free rate is 6% and the

Q32: Bad managerial judgments or unforeseen negative events

Q59: The coefficient of variation, calculated as the

Q91: Stocks A and B both have an

Q92: A firm can change its beta through

Q120: A portfolio's risk is measured by the

Q136: The real risk-free rate is 2%,the expected