Multiple Choice

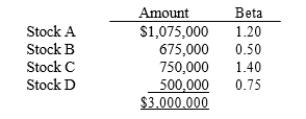

Assume that you are the portfolio manager of the Coastal Fund, a $3 million hedge fund that contains the following stocks. The required rate of return on the market is 14.00% and the risk-free rate is 6.00%. What rate of return should investors expect (and require) on this fund?

A) 13.44%

B) 13.79%

C) 14.14%

D) 14.49%

Correct Answer:

Verified

Correct Answer:

Verified

Q12: What happens to portfolios that cannot be

Q14: Stock A's beta is 1.5 and Stock

Q14: Jane has a portfolio of 20 average

Q15: Diversifiable risk plays an important factor pricing

Q22: Stock A has an expected return of

Q24: Which of the following statements is correct?<br>A)

Q42: Since the market return represents the expected

Q63: Which of the following statements is correct?<br>A)A

Q129: Which of the following statements is correct?<br>A)A

Q140: Keith Johnson has $100,000 invested in a