Multiple Choice

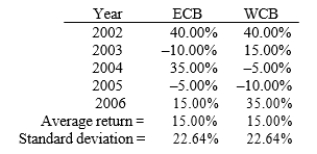

Campbell's father holds just one stock, East Coast Bank (ECB) , which he thinks is a very low-risk security. Campbell agrees that the stock is relatively safe, but he wants to demonstrate that his father's risk would be even lower if he were more diversified. Campbell obtained the following returns data shown for West Coast Bank (WCB) . Both have had less variability than most other stocks over the past 5 years. Measured by the standard deviation of returns, by how much would his father's historical risk have been reduced if he had held a portfolio consisting of 60% ECB and the remainder in WCB? (Hint: Use the sample standard deviation formula.)

A) 3.56%

B) 3.65%

C) 3.74%

D) 3.84%

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Which of the following statements is correct?<br>A)The

Q24: The slope of the SML is determined

Q26: Any change in beta is likely to

Q47: Risk-averse investors require higher rates of return

Q61: For diversified investors, the appropriate measure of

Q103: Bertin Bicycles has a beta of 0.88

Q119: Diversification can reduce the riskiness of a

Q127: You are given the following returns on

Q129: The larger the number of assets in

Q148: Which of the following statements is correct?<br>A)A