Essay

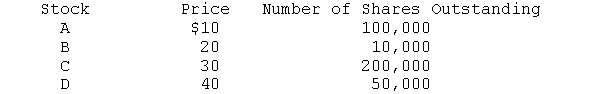

The market consists of the following stocks. Their prices and number of shares are as follows:

a. The price of Stock C doubles to $60. What is the percentage increase in the market if a S&P 500 type of measure of the market (value-weighted average) is used?

b. Repeat question (a) but use a Value Line type of measure of the market (i.e., a geometric average) to determine the percentage increase.

c. Suppose the price of stock B doubled instead of stock C. How would the market have fared using the aggregate measures employed in (a) and (b)? Why are your answers different?

Correct Answer:

Verified

The S&P 500 uses a value?weighted averag...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q7: To determine the realized return on an

Q14: With dollar-cost averaging, the investor purchases more

Q18: Aggregate securities prices may be measured by

Q20: The S&P 500 uses<br>A)a simple average<br>B)a compound

Q21: Studies of realized rates of return assume

Q22: The Russell 1000 index<br>A) combines 1000 stocks

Q24: Given the following information concerning three stocks,

Q26: The Russell 3000 is a broad-based measure

Q26: Movements in individual stock prices tend to

Q27: You bought a stock for $28.29 that