Essay

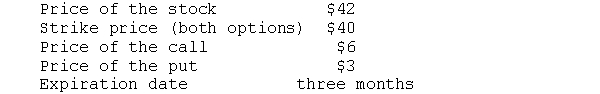

You obtain the following information concerning a stock, a call option, and a put option  You want to purchase the stock but also want to use an option to reduce your risk of loss.

You want to purchase the stock but also want to use an option to reduce your risk of loss.

a. Do you purchase the put or the call or do you sell the put or the call?

b. What is the cash inflow or outflow from your position?

c. What is profit or loss if the price of the stock stagnates and trades for $42 after three months?

d. What is profit or loss if the price of the stock trades for $50 or $100 after three months?

e. What is profit or loss if the price of the stock trades for $30 after three months?

Correct Answer:

Verified

To establish the protect put, ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q11: If an investor constructs a covered call,<br>A)there

Q18: A writer of a naked call option

Q32: The price of an option is generally

Q35: Call options, unlike warrants, may be written

Q43: The time period to expiration for call

Q51: The strike price of an option is

Q71: The most the investor who sells a

Q80: The intrinsic value of an option to

Q83: An investor may reduce risk by simultaneously

Q84: The intrinsic value of a put depends