Essay

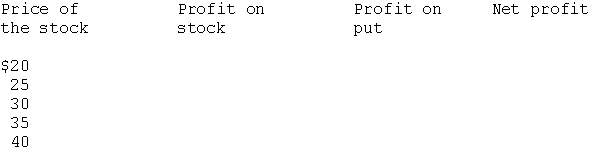

A put and a call have the following terms:Call: strike price $30term three monthsprice $3Put: strike price $30term three monthsprice $4The price of the stock is currently $29. You sell the stock short and purchase the call. Complete the following table and answer the questions.

a. What is the maximum possible profit on the position?

b. What is the maximum possible loss on the position?

c. What is the range of stock prices that generates a profit?

d. What advantage does this position offer?

Correct Answer:

Verified

Profit/loss profile:

a. The maximum po...

a. The maximum po...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: The VIX is<br>A)an index of option prices<br>B)an

Q8: Put-call parity explains why a change in

Q9: If a call is overvalued, put-call parity

Q10: The price of a stock is $46

Q17: If an individual sells a stock short,

Q18: According to put-call parity, if a stock

Q24: To acquire a straddle, the investor<br>A) buys

Q29: According to the Black/Scholes option valuation model,

Q37: According to the Black/Scholes option valuation model,

Q38: Writing both a put and a call