Essay

Schultz Tax Services, a tax preparation business, had the following transactions during the month of June:

1. Received cash for providing accounting services, $3,000.

2. Billed customers on account for providing services, $7,000.

3. Paid advertising expense, $800.

4. Received cash from customers on account, $3,800.

5. Owner made a withdrawal, $1,500.

6. Received telephone bill, $220.

7. Paid telephone bill, $220.

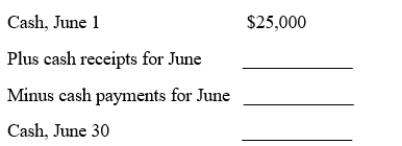

Based on the information given above, calculate the balance of cash at June 30. Use the following reconciliation.

Correct Answer:

Verified

Correct Answer:

Verified

Q211: The role of accounting is to provide

Q212: Which of the following financial statements reports

Q213: Match the following business types with each

Q214: Match each transaction with its effect on

Q215: Using the following accounting equation elements

Q217: A statement of owner's equity reports the

Q218: About 90% of the businesses in the

Q219: The objectivity concept requires that<br>A) business transactions

Q220: Proper ethical conduct implies that you only

Q221: A merchandising business buys products from other