Essay

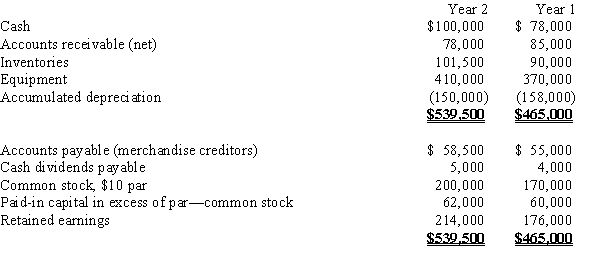

On the basis of the following data for Larson Co. for the year ending December 31 Year 2, and the preceding year ended December 31, Year 1, prepare a statement of cash flows. Use the indirect method of reporting cash flows from operating activities. In addition to the balance sheet data, assume that:Equipment costing $125,000 was purchased for cash.Equipment costing $85,000 with accumulated depreciation of $65,000 was sold for $15,000.The stock was issued for cash.The only entries in the retained earnings account were net income of $51,000 and cash dividends declared of $13,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q68: Net income for the year was $29,500.

Q69: Which of the following should be added

Q70: A building with a book value of

Q71: Cash paid for equipment would be reported

Q72: The cost of merchandise sold during the

Q74: The income statement disclosed the following items

Q75: For each of the following activities that

Q76: Using the indirect method, if land costing

Q77: Equipment with an original cost of $75,000

Q78: Accounts receivable from sales transactions were $51,000