Essay

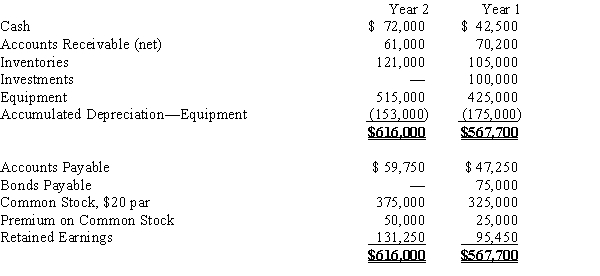

The comparative balance sheets of Barry Company, for Years 1 and 2 ended December 31, appear below in condensed form.  Additional data for the current year are as follows:

Additional data for the current year are as follows:

(a)Net income, $75,800.

(b)Depreciation reported on income statement, $38,000.

(c)Fully depreciated equipment costing $60,000 was scrapped, no salvage, and equipment was purchased for $150,000.

(d)Bonds payable for $75,000 were retired by payment at their face amount.

(e)2,500 shares of common stock were issued at $30 for cash.

(f)Cash dividends declared and paid, $40,000.

(g)Investments of $100,000 were sold for $125,000.Prepare a statement of cash flows using the indirect method.

Correct Answer:

Verified

Correct Answer:

Verified

Q11: Which of the following increases cash?<br>A) depreciation

Q12: Under the direct method of reporting cash

Q13: Which of the following should be deducted

Q14: Kennedy, Inc. reported the following data:? <img

Q15: Identify the section of the statement of

Q17: The direct method of preparing the operating

Q18: Accounts receivable from sales to customers amounted

Q19: Cash flows from operating activities, as part

Q20: Firefly Inc. sold land for $225,000 cash.

Q21: Cash dividends paid on capital stock would