Essay

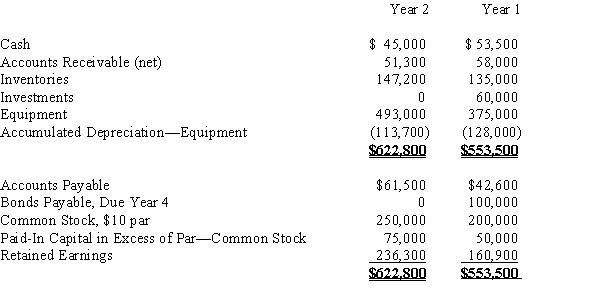

The comparative balance sheets of ConnieJo Company, for Years 1 and 2 ended December 31, appear below in condensed form.  The income statement for the current year is as follows:

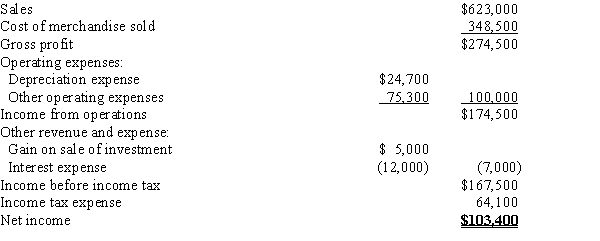

The income statement for the current year is as follows:  Additional data for the current year are as follows:

Additional data for the current year are as follows:

(a)Fully depreciated equipment costing $39,000 was scrapped, no salvage, and equipment was purchased for $157,000.

(b)Bonds payable for $100,000 were retired by payment at their face amount.

(c)5,000 shares of common stock were issued at $15 for cash.

(d)Cash dividends declared were paid, $28,000.

(e)All sales are on account.Prepare a statement of cash flows using the direct method of reporting cash flows from operating activities.

Correct Answer:

Verified

Correct Answer:

Verified

Q138: A company had net income of $252,000.

Q139: Net income was $51,000 for the year.

Q140: On the statement of cash flows prepared

Q141: Cash flows from investing activities, as part

Q142: A 10-year bond was issued at par

Q144: The current period statement of cash flows

Q145: To determine cash payments for operating expenses

Q146: The order of presentation of activities on

Q147: The statement of cash flows is not

Q148: In preparing the Cash flows from operating