Essay

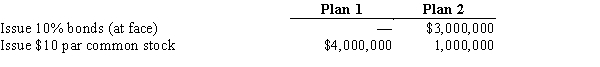

Sorenson Co. is considering the following alternative plans for financing the company:  Income tax is estimated at 40% of income.Determine the earnings per share of common stock under the two alternative financing plans, assuming income before bond interest and income tax is $1,000,000.

Income tax is estimated at 40% of income.Determine the earnings per share of common stock under the two alternative financing plans, assuming income before bond interest and income tax is $1,000,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q94: The present value of the periodic bond

Q95: On January 1, Gemstone Company obtained a

Q96: On January 1, Marshall Co. issued a

Q97: On June 30, Jamison Company issued $2,500,000

Q98: Any unamortized premium should be reported on

Q100: A corporation issues for cash $1,000,000 of

Q101: The amount of interest expense reported on

Q102: The journal entry a company records for

Q103: A $500,000 bond issue on which there

Q104: Match each description below to the appropriate