Essay

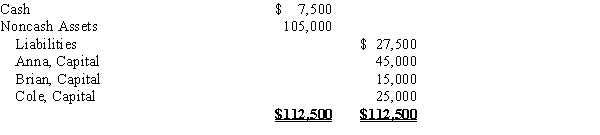

After discontinuing the ordinary business operations and closing the accounts on May 7, the ledger of the partnership of Anna, Brian, and Cole indicated the following:  The partners share net income and losses in the ratio of 3:2:1. Between May 7 and May 30, the noncash assets were sold for $150,000, the liabilities were paid, and the remaining cash was distributed to the partners.

The partners share net income and losses in the ratio of 3:2:1. Between May 7 and May 30, the noncash assets were sold for $150,000, the liabilities were paid, and the remaining cash was distributed to the partners.

(a)Prepare a statement of partnership liquidation.

(b)Assume the same facts as in

(a), except that the noncash assets were sold for $45,000 and any partner with a capital deficiency pays the amount of the deficiency to the partnership. Prepare a statement of partnership liquidation.

Correct Answer:

Verified

Correct Answer:

Verified

Q138: If the net income of a partnership

Q139: Which of the following is not one

Q140: Revenue per employee may be used to

Q141: When a new partner is admitted to

Q142: X sells to A one-half of a

Q144: Match each statement to the appropriate term

Q145: Immediately prior to the process of liquidation,

Q146: Everett, Miguel, and Ramona are partners, sharing

Q147: When a limited liability company is formed,<br>A)

Q148: Teri, Doug, and Brian are partners with