Essay

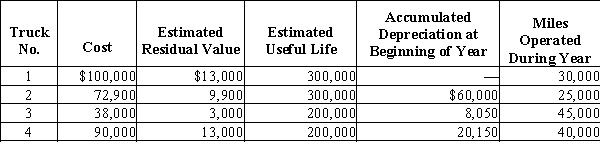

Prior to adjustment at the end of the year, the balance in Trucks is $300,900 and the balance in Accumulated Depreciation-Trucks is $88,200. Details of the subsidiary ledger are as follows:??  Required

Required

(a)Based on the units-of-activity method, determine the depreciation rates per mile and the amount to be credited to the Accumulated depreciation section of each of the subsidiary accounts for the miles operated during the current year.

(b)Journalize the entry to record depreciation for the year.

Correct Answer:

Verified

(a)?  (b)Depreciatio...

(b)Depreciatio...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q25: Machinery acquired at a cost of $80,000

Q26: The journal entry for recording payment for

Q27: Match each account name to the financial

Q28: Classify each of the following costs associated

Q29: Classify each of the following costs associated

Q31: The acquisition costs of property, plant, and

Q32: A fixed asset with a cost of

Q33: It is necessary for a company to

Q34: Newport Company has sales of $2,025,000 for

Q35: Match the intangible assets described with their