Essay

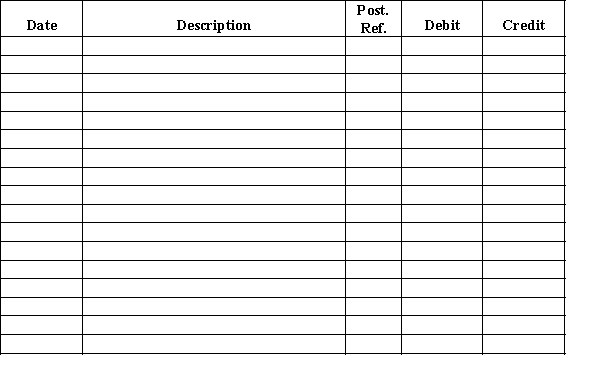

Equipment acquired at a cost of $126,000 has a book value of $42,000. Journalize the disposal of the equipment under the following independent assumptions.

(a)The equipment had no market value and was discarded.

(b)The equipment is sold for $54,000.

(c)The equipment is sold for $24,000.

(d)The equipment is traded in for a similar asset. The list price of the new equipment is $63,000. The buyer gave no cash in the exchange. The transaction lacks commercial substance.Journal

Correct Answer:

Verified

Correct Answer:

Verified

Q47: Classify each of the following as:<br>-Paving a

Q48: A fixed asset with a cost of

Q49: Losses on the discarding of fixed assets

Q50: The double-declining-balance method is an accelerated depreciation

Q51: When depreciation estimates are revised, all years

Q53: A copy machine acquired on July 1

Q54: Which of the following is included in

Q55: A machine with a cost of $75,000

Q56: The following information was taken from

Q57: Match each account name to the financial