Short Answer

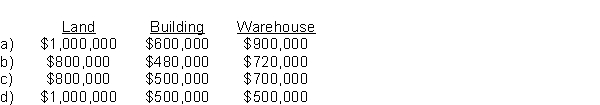

Mertle Holdings Co. purchased 12 acres of land with an office building and warehouse on it for $2,000,000. The assets were appraised at: land $1,000,000, building $600,000, and warehouse $900,000. The assets were carried on the seller's books at: land $800,000, building $500,000, and warehouse $700,000. At what cost should the purchasing company record each of the assets?

Correct Answer:

Verified

Correct Answer:

Verified

Q17: Upon the disposal of an asset,if the

Q26: The ultimate sales value of a long-term

Q32: The cash inflows generated from a long-term

Q51: Proctor Paper Products purchased a machine on

Q53: Electronics R Us spent $25,000 on research

Q54: In 2017 as part of a property

Q54: Harmax Limited spent $5,000 registering an internally

Q57: The maximum capital cost allowance (CCA) that

Q67: The depreciation method that most closely resembles

Q69: Assets that produce their greatest benefits to