Short Answer

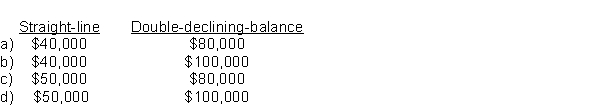

A company is depreciating a $1,000,000 building using a straight-line rate of 5%. The building has an estimated residual value of $200,000. What would the amount of depreciation be in the first year using the straight-line method and the double-declining-balance method?

Correct Answer:

Verified

Correct Answer:

Verified

Q4: According to accounting standards,the method of depreciation

Q9: An asset that cost $16,200 with a

Q11: The unexpensed portion of an depreciable asset

Q16: Use the following information for questions 47-49.<br>On

Q17: Use the following information for questions 43-44.<br>Jeremiah

Q20: Which of the following is NOT a

Q30: Which of the following methods of amortization

Q56: An asset with an original cost of

Q61: The correct entry to record the annual

Q70: Which of the following amortization methods ignore