Essay

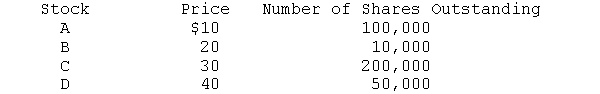

The market consists of the following stocks. Their prices and number of shares are as follows:

a. The price of Stock C doubles to $60. What is the percentage increase in the market if a S&P 500 type of measure of the market (value-weighted average) is used?

b. Repeat question (a) but use a Value Line type of measure of the market (i.e., a geometric average) to determine the percentage increase.

c. Suppose the price of stock B doubled instead of stock C. How would the market have fared using the aggregate measures employed in (a) and (b)? Why are your answers different?

Correct Answer:

Verified

The S&P 500 uses a value?weighted averag...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: Historical studies of investment returns suggest that

Q15: Studies of investments returns (e.g., the Ibbotson

Q17: Which of the following is the least

Q20: If a stock rose from $10 to

Q22: The Russell 1000 index<br>A) combines 1000 stocks

Q23: Indices of Nasdaq stocks tend to be

Q26: The Russell 3000 is a broad-based measure

Q32: Dollar-cost averaging is achieved by periodic, equal

Q35: You sold 200 shares of DOG short

Q41: Realized returns should include both dividends and