Essay

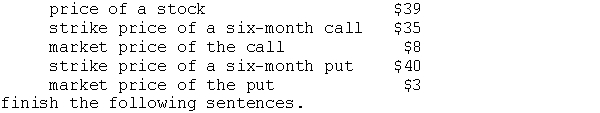

Given the following information,

a. The intrinsic value of the call is _________.

b. The intrinsic value of the put is _________.

c. The time premium paid for the call is _________.

d. The time premium paid for the put is _________.

At the expiration of the options (i.e., after six months have lapsed), the price of the stock is $45.

e. The profit (loss) from buying the call is _______.

Correct Answer:

Verified

$39 - $35 = $4 b. $40 - $39 = $1 c. $8 -...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q12: The CBOE is1. a secondary market in

Q12: What are the following call options' intrinsic

Q18: A writer of a naked call option

Q21: A put is the option to sell

Q29: The most the individual who buys a

Q55: A writer of a call option closes

Q65: Holders of calls do not receive the

Q70: If an investor anticipates that interest rates

Q81: If the price of a stock rises

Q85: As the price of a stock rises,