Essay

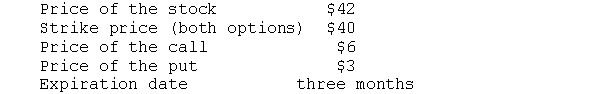

You obtain the following information concerning a stock, a call option, and a put option

You want to purchase the stock but also want to use an option to reduce your risk of loss.

a. Do you purchase the put or the call or do you sell the put or the call?

b. What is the cash inflow or outflow from your position?

c. What is profit or loss if the price of the stock stagnates and trades for $42 after three months?

d. What is profit or loss if the price of the stock trades for $50 or $100 after three months?

e. What is profit or loss if the price of the stock trades for $30 after three months?

Correct Answer:

Verified

To establish the protect put, ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q12: What are the following call options' intrinsic

Q12: The CBOE is1. a secondary market in

Q12: If an investor is bearish, he or

Q18: Options sell for a time premium over

Q21: A put is the option to sell

Q37: The CBOE is a secondary market for

Q48: A put is an option to<br>A)buy stock<br>B)receive

Q61: The price of a call depends on<br>1.

Q66: An option's intrinsic value exceeds the option's

Q81: If the price of a stock rises