JP Company Is Considering Two Capital Investment Proposals The Company Requires an 11% Rate of Return on All

Multiple Choice

JP Company is considering two capital investment proposals. Estimates regarding each project are provided below: The company requires an 11% rate of return on all new investments.  The cash payback period for Project Echo is

The cash payback period for Project Echo is

A) 20 years.

B) 10 years.

C) 5 years.

D) 4 years.

Correct Answer:

Verified

Correct Answer:

Verified

Q159: If a company must expand capacity to

Q160: Oscar Co. is contemplating the replacement

Q161: If the payback period for a project

Q162: Flamingo Music produces 60000 CDs on

Q163: Which of the following would generally not

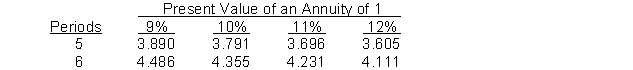

Q165: Use the following table <span

Q166: An investment costing $90000 is being contemplated

Q167: A company is considering purchasing factory equipment

Q168: It costs Maker Company $22 of variable

Q169: The focus of a sell or process