Essay

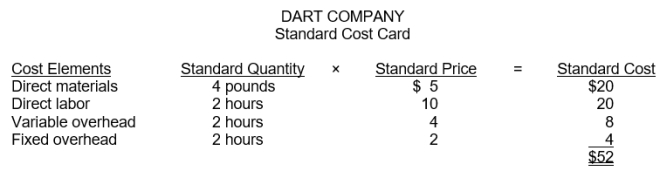

Dart Company developed the following standard costs for its product for 2016:  The company expected to work at the 120000 direct labor hours level of activity and produce 60000 units of product.

The company expected to work at the 120000 direct labor hours level of activity and produce 60000 units of product.

Actual results for 2016 were as follows:

56800 units of product were actually produced.

Direct labor costs were $1092000 for 112000 direct labor hours actually worked.

Actual direct materials purchased and used during the year cost $1108800 for 231000 pounds.

Total actual manufacturing overhead costs were $680000.

Instructions

Compute the following variances for Dart Company for 2016 and indicate whether the variance is favorable or unfavorable.

1. Direct materials price variance.

2. Direct materials quantity variance.

3. Direct labor price variance.

4. Direct labor quantity variance.

5. Overhead controllable variance.

6. Overhead volume variance.

Correct Answer:

Verified

1. Labor quantity variance  Actual hours...

Actual hours...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q194: Variance reports are<br>A) external financial reports.<br>B) SEC

Q195: Which of the following statements is true?<br>A)

Q196: The direct materials quantity standard should<br>A) exclude

Q197: Jackson Manufacturing planned to produce 20000

Q198: The standard direct labor cost for producing

Q200: In concept standards and budgets are essentially

Q201: A company developed the following per-unit standards

Q202: The budgeted overhead costs for standard hours

Q203: Budgeted overhead for Haft Inc. at normal

Q204: The balanced scorecard<br>A) incorporates financial and nonfinancial