Essay

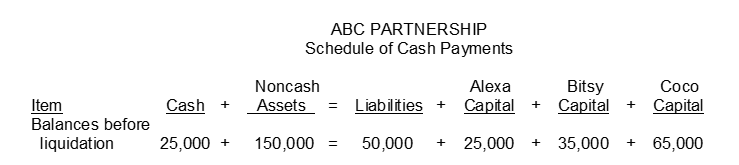

The ABC Partnership is to be liquidated and you have been hired to prepare a Schedule of Cash Payments for the partnership. Partners Alexa Bitsy and Coco share income and losses in the ratio of 4:3:3 respectively. Assume the following:

1. The noncash assets were sold for $70000.

2. Liabilities were paid in full.

3. The remaining cash was distributed to the partners. (If any partner has a capital deficiency assume that the partner is unable to make up the capital deficiency.)

Instructions

Using the above information complete the Schedule of Cash Payments below:

Correct Answer:

Verified

Correct Answer:

Verified

Q123: Hu Marcos and Letterman share income on

Q124: Actor Brees and Cotswald are forming The

Q125: Capital balances in Carson Co. are Dene

Q126: Partners Gary and Elaine have agreed to

Q127: On November 30 capital balances are Ross

Q129: The partners' drawing accounts are<br>A) reported on

Q130: M. Abadie and S. Collier combine their

Q131: If a new partner is admitted into

Q132: Which of the following statements about partnerships

Q133: Elkins and Landry are partners who share