Essay

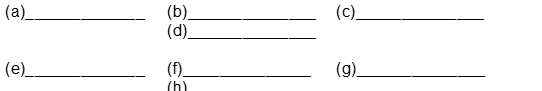

Fleming Company purchased a machine on January 1 2017. In addition to the purchase price paid the following additional costs were incurred: (a) sales tax paid on the purchase price (b) transportation and insurance costs while the machinery was in transit from the seller (c) personnel training costs for initial operation of the machinery (d) annual city operating license (e) major overhaul to extend the life of the machinery (f) lubrication of the machinery gearing before the machinery was placed into service (g) lubrication of the machinery gearing after the machinery was placed into service and (h) installation costs necessary to secure the machinery to the building flooring.

Instructions

Indicate whether the items (a) through (h) are capital or revenue expenditures in the spaces provided: C = Capital R = Revenue.

Correct Answer:

Verified

Correct Answer:

Verified

Q17: Nicholson Company purchased equipment on January 1

Q18: The cost of a new asset acquired

Q19: The units-of-activity method is generally not suitable

Q20: On July 4 2017 Wyoming Mining Company

Q21: With the exception of land plant assets

Q23: The cost of paving fencing and lighting

Q24: The book value of a plant asset

Q25: Which of the following is not true

Q26: A change in the estimated salvage value

Q27: When constructing a building a company is