Essay

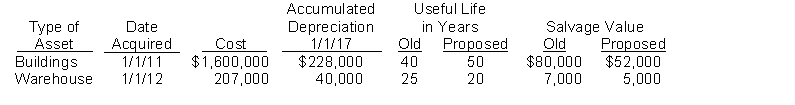

Frank White the new controller of Youngman Company has reviewed the expected useful lives and salvage values of selected depreciable assets at the beginning of 2017. His findings are as follows.  All assets are depreciated by the straight-line method. Youngman Company uses a calendar year in preparing annual financial statements. After discussion management has agreed to accept Frank's proposed changes.

All assets are depreciated by the straight-line method. Youngman Company uses a calendar year in preparing annual financial statements. After discussion management has agreed to accept Frank's proposed changes.

Instructions

(a) Compute the revised annual depreciation on each asset in 2017. (Show computations.)

(b) Prepare the entry (or entries) to record depreciation on the building in 2017.

Correct Answer:

Verified

None...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q200: For each entry below make a correcting

Q201: The cost of a patent must be

Q202: The factor that is not relevant in

Q203: When vacant land is acquired expenditures for

Q204: The cost of natural resources is not

Q206: Carey Company buys land for $50000 on

Q207: In an exchange of plant assets that

Q208: The cost of demolishing an old building

Q209: Match the items below by entering the

Q210: Gorman Mining invested $960000 in a mine