Essay

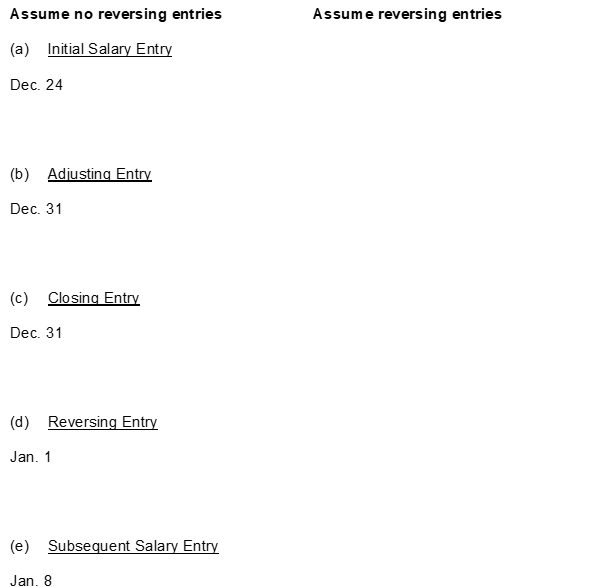

Transaction and adjustment data for Ortiz Company for the calendar year end is as follows:

1. December 24 (initial salary entry): $15000 of salaries earned between December 1 and December 24 are paid.

2. December 31 (adjusting entry): Salaries earned between December 25 and December 31 are $4500. These will be paid in the January 8 payroll.

3. January 8 (subsequent salary entry): Total salary payroll amounting to $7000 was paid.

Instructions

Prepare two sets of journal entries as specified below. The first set of journal entries should assume that the company does not use reversing entries and the second set should assume that reversing entries are utilized by the company.

Correct Answer:

Verified

Correct Answer:

Verified

Q129: A worksheet is an optional working tool

Q130: Liabilities are generally classified on a balance

Q131: All of the following are property plant

Q132: The trial balances of Orton Company

Q133: Adjusting entries are prepared from<br>A) source documents.<br>B)

Q135: The classified balance sheet is<br>A) required under

Q136: The following selected account balances appear

Q137: The final step in the accounting cycle

Q138: The first step in preparing a worksheet

Q139: The balance in the income summary account