Multiple Choice

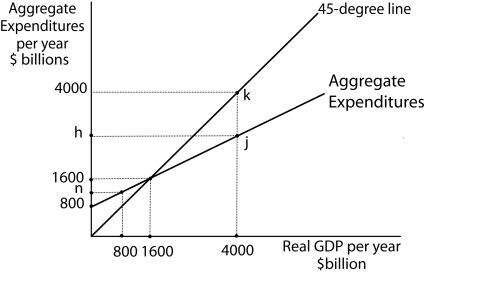

Figure 13-6

-Refer to Figure 13-6. Let Y = real GDP, AE = Aggregate Expenditures, C = Consumption,

IP = Planned Investment, G = Government Purchases. Further, IP and G are autonomous. If real GDP produced is $4,000,

A) consumers and firms would demand more than was produced.

B) the economy experiences an inflationary gap.

C) firms will experience unplanned inventories accumulation.

D) the price level must rise to reduce aggregate expenditures and restore equilibrium.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Holding all else constant, a change in

Q63: Let AE = Aggregate Expenditures, C =

Q78: Figure 13-6 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5507/.jpg" alt="Figure 13-6

Q82: In the aggregate expenditures model, if a

Q115: The wealth effect is the tendency for<br>A)

Q125: Consider a simple aggregate expenditure model where

Q161: According to the current income hypothesis,<br>A) a

Q177: In the aggregate expenditures model, if aggregate

Q202: If C = $400 billion + 0.75(Y<sub>d</sub>)

Q215: Figure 13-3 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5507/.jpg" alt="Figure 13-3