Essay

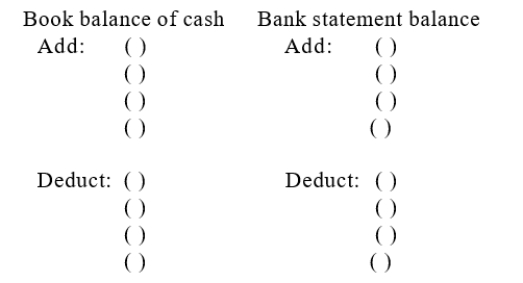

Below, preceded by identifying letters, are seven items that would cause XavierSales Company's book balance of cash to differ from its bank statement balance.(a)A service charge made by the bank.(b)A cheque listed as outstanding on the previous month's reconciliation that is still outstanding.(c)A customer's cheque returned by the bank marked "Not SufficientFunds."(d)A deposit consisting solely of cheques which was mailed to the bank on the last day of November and is unrecorded on the November bankstatement.(e)A cheque paid by the bank at its correct $190 amount but recorded in error in the Cheque Register at $109.(f)An unrecorded credit memorandum indicating the bank had collected a note receivable for Xavier Sales Company and deposited the proceeds in the company's account.(g)A cheque written but not yet paid or returned by the bank.Indicate where each item would appear on Xavier Sales Company's bankreconciliation by placing its identifying letter in the parentheses in the proper section of the form below.

Correct Answer:

Verified

Correct Answer:

Verified

Q46: Principles of internal control include:<br>A)Maintain adequate records.<br>B)Insure

Q49: Cash equivalents:<br>A)Include chequing accounts.<br>B)Include 6-month certificates of

Q51: Guy Company's records revealed the following data

Q52: Outstanding cheques are cheques that:<br>A)Have been written,

Q53: Prepare the journal entries resulting from the

Q54: The entry to record reimbursement of the

Q57: Liquidity measures how easily assets can be

Q78: An NSF cheque for $17.50 would be

Q120: Identify the principles of internal control.

Q142: Discuss the purpose of an internal control