Multiple Choice

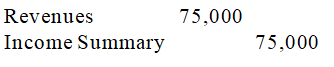

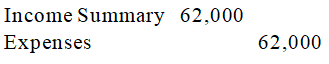

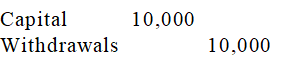

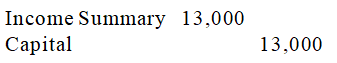

A company had revenues of $75,000, withdrawals of $10,000 and expenses of $62,000

during an accounting period. Which of the following entries should not be journalized in the closing process?

A)

B)

C)

D)

E) All of these should be journalized in the closing process.

Correct Answer:

Verified

Correct Answer:

Verified

Q27: Explain why closing entries are a necessary

Q38: Emilia Feridy, the proprietor of EF Services,

Q39: Which of the following is the final

Q40: Which statement is true about liquidity? Prepaid

Q41: Real accounts are<br>A)Not shown on the balance

Q42: The ending balance of owner's capital is

Q46: ) The items that follow appeared in

Q47: The special account used only in the

Q126: Indicate beside each of the following accounts

Q145: Describe a classified balance sheet.