Essay

MegaTech Company has total monthly revenues of $325,000 and expenses of

$198,000 for the month ended July 31 before monthly adjusting entries are made. The following data are provided on the end of month adjustments to be made:

a. Insurance expired in July, $2,520.

b. Unbilled amounts to customers for July is $4,200.

c. Salaries earned by employees but not yet paid by MegaTech for the last week of July, $13,125.

d. Depreciation on equipment for July, $1,290.

e. Supplies used in July, $1,650.

f. Fees collected in advance from customers which have now been earned during

July, $23,400.

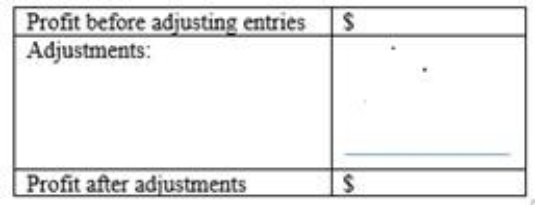

Complete the schedule below to determine the profit of MegaTech for July after these adjustments are recorded. Begin your schedule with income before

adjusting entries and then show the effect of each adjustment to arrive at profit

after adjustment.

Correct Answer:

Verified

Correct Answer:

Verified

Q37: Prepare an income statement for the year

Q39: An adjusting entry could be made for

Q40: The accounting basis that attempts to measure

Q43: Correcting entries are a specialized type of

Q43: A business pays each of its two

Q44: The Creative Company has several insurance policies

Q45: Adjusting entries are posted to the general

Q91: Under the alternative method for recording prepaid

Q173: Discuss the types of adjusting entries used

Q182: Adjusting entries are always dated at the